Explain Difference Between Zakat and Ushr

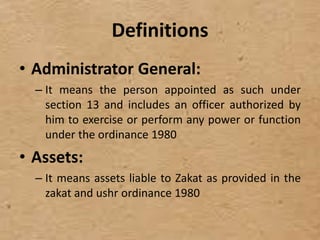

Posted at Dec 042010 0423PM. The zakah and ushr system in Pakistan was introduced through Zakat and Ushr Organisation Ordinance 1979 issued on June 24 1979 for the establishment of zakah organisations at.

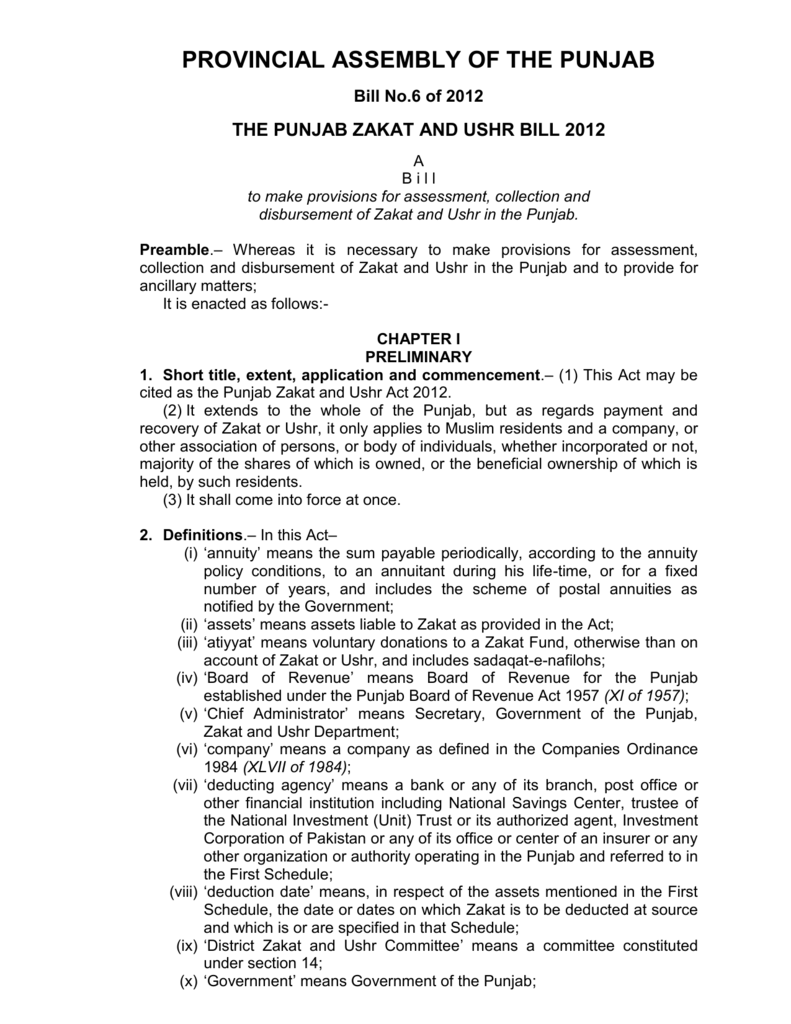

New Zakat Ushr Law 2010 Provincial Assembly Of Punjab

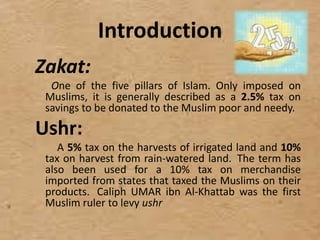

The principal taxes were the tithe on the produce of the land called ushr and the zakat fortieth on merchandise and cattle.

. Ushr means in Arabic one tenth that is one tenth of the harvest should be given to the poor if the harvest is realized without irrigation. They are based on both the legal status of taxable land and on the communal or religious status of the taxpayer. I ask Allah to make this a sincere effort.

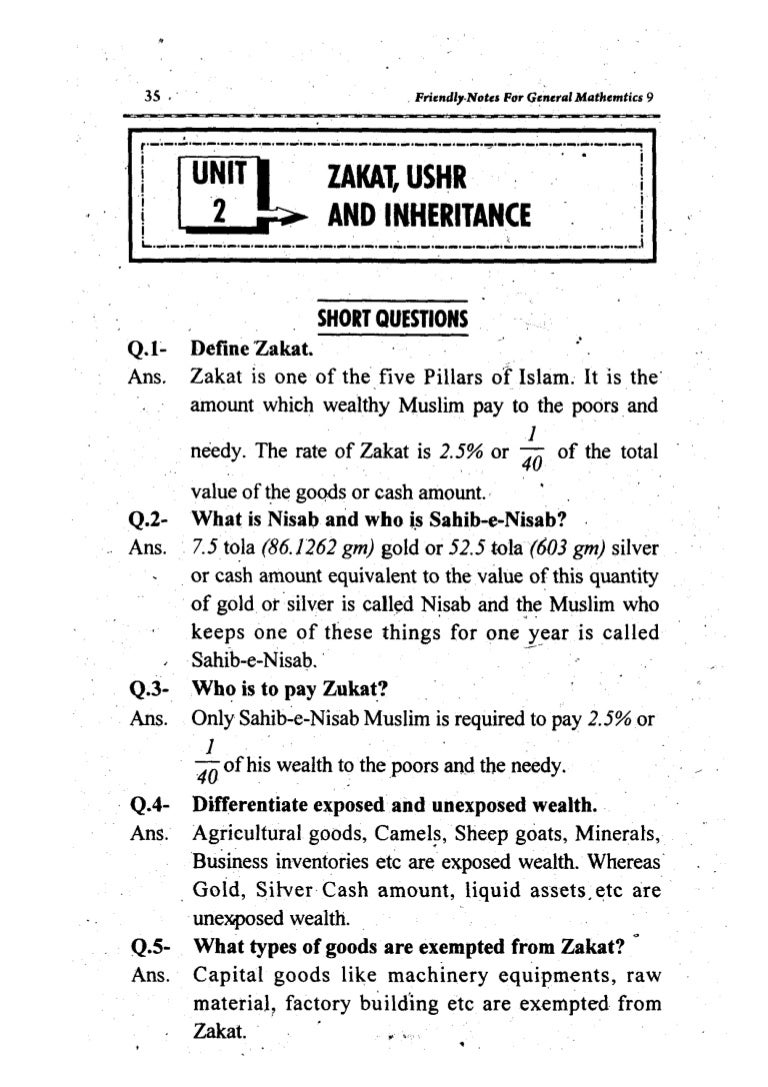

And Allah alone knows the best. If Zakat and Ushr are fully collected according to the letter and distributed to the deserving we can expect to root out poverty from Pakistan. Zakat is officially and obligatorily collected at 25 on 11 assets determined in the 1980 Zakat and Ushr Ordinance under Schedule One.

The Zakat and Ushr Ordinance was issued on 20 June 1980. Zakat al-mal or zakah al. Knowledges purpose to shun the ignorance.

Taxation Model in Public Finance. Only imposed on Muslims it is generally described as a 25 tax on. Islamic taxes are taxes sanctioned by Islamic law.

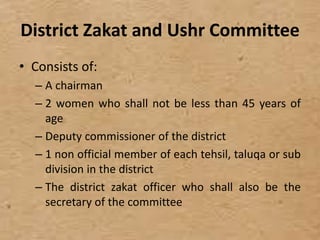

The humility of Newton. Jizya was protection tax which served following purpose in. A Zakat district normally corresponds to a civil district in.

Zakat al-Mal Definition. If this is done there is no reason that we will not observe a significant positive change. Mufti e DawateIslami shared very good information differences between Zakat and Usher in a famous program of Madani Channel named.

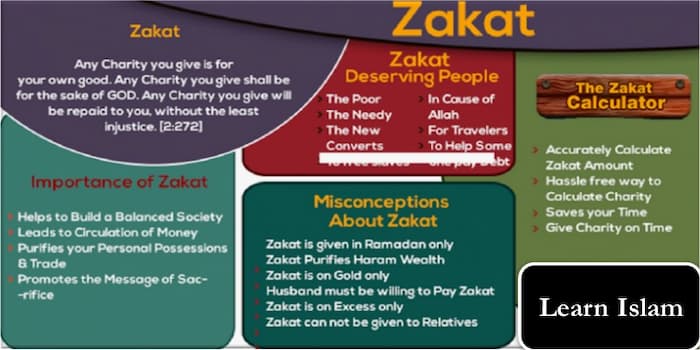

The word zakat means purity development blessings and praise but in practice it refers to alms - money or food that is given to the poor 1. The authors discuss Islams perspective on Zakat and its link with what they. Ushr becomes obligatory when a beliver has land that produces fruitscrops etc.

Its urban componentzakat took effect in 1981 whereas ushr did not come into effect until 1983. District Zakat and Ushr Committees are responsible for exercising control over the affairs of the District and Local Zakat Committees. Muslims also paid another tax on agriculture produce called ushr.

All other assets fall under Schedule Two. There is a comment by SR. Shortcomings our little learning.

Mans hopelessness before the vastness of the knowledge. The system by which these. Aziz F Fahim S.

Zakat is on savings if your wealth is above a minimum threshold. In addition to the required alms Muslims are encouraged to give in charity at all times according to their means. The Life of Yakoob Beg Demetrius Boulger.

Zakat is meant to be spent for specified objectives which are. One of the five pillars of Islam. The second called the.

Darul Ifta Ahle SunnatCli. Zakat Ushr 1 1. Khan on pp 950-952.

A term used in Islamic finance to refer to the obligation that an individual has to donate a certain proportion of wealth each year to charitable causes. If the farmer spent extra resources such as on irrigation. There is difference between Zakat and tax in respect of the utilisation of respective fund whereas tax can be spent for any purpose.

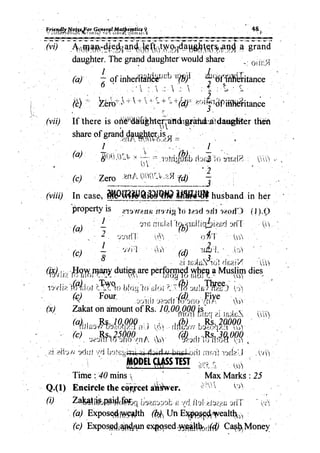

Distribution of wealth like Zakat Ushr Charity and Inheritance should be properly applied. The kharaj and ushr were two forms of taxation by which the Muslim authorities extracted revenue from their subjects.

Unit02 Zakat Ushr And Inheritance

Ushr Tithe Khalifatullah Mehdi

Latest Jobs In Ajk Zakat And Ushr Department 2021 Advertisement Jobs In Pakistan Job Advertising

Zakat And Ushr Department Kpk Jobs 2021 November December Etea Apply Online Computer Operators Others Latest Job Current Job Jobs For Freshers

Unit02 Zakat Ushr And Inheritance

Ushr Kay Ahkam Pdf Urdu Book Book Hut Free Pdf Books Pdf Books Pdf Download

Pdf Zakat And Ushr Ordinance 1980 Doc Mohammad Rasool Khan Academia Edu

Zakat And Ushr Tips And Tricks Nts Gmat Hat Gre Pakistani Tests Youtube

How To Find Usher In Islam Zakat On Crops Islamic Taxes Math Dot Com Youtube

What Is Ushr According To Quran And Hadith Quran Mualim

Pdf Zakat Kharaj Ushr And Jizya As The Instruments Of Islamic Public Finance A Contemporary Study

What Is Ushr According To Quran And Hadith Quran Mualim

What Is Ushr According To Quran And Hadith Quran Mualim

Disabled Person Jobs In Punjab Zakat And Ushr Department 2021 Jobs In Pakistan Person Job

Comments

Post a Comment